Become A Private Mortgage Lender In Canada

With more than $1Billion in successful mortgage placements, CMI Mortgage Investments is one of Canada’s fastest-growing non-bank financial services providers. Our industry-leading whole mortgage investment program provides direct exposure to Canada’s residential mortgage market.

AS FEATURED ON

Learn How Private Lending Opportunities Can Help Diversify Your Investment Portfolio

As more buyers turn to private lenders to secure their residential mortgages, there has never been a better time to become a private lender in Canada.

CMI provides investors with private lending opportunities in key residential real estate markets across Canada. We target Canadian centres with strong economic fundamentals and employ an extensive and rigorous mortgage qualification process. We get to know our investors and present you with Canadian real estate investment opportunities that best suit your profile.

Investing In Mortgages

The Opportunity

Income

CMI investors can earn anywhere between 6% and 16% annually on their mortgage investments – considerably higher than the average yield of traditional fixed-income securities. Our goal is to maximize your returns based on your investment goals and preferences.

Security

Your mortgage lending investment is backed by the borrower’s property, and steady, reliable monthly income is generated when the borrower makes their mortgage payments.

Protection

Mortgage investments are uncorrelated with public markets and provide a compelling opportunity for investors looking to add return potential to their portfolio without assuming additional risk

Book a ConsultationRegional Highlights

With real estate a key economic driver for the province, British Columbia offers mortgage investors a compelling growth opportunity. The Greater Vancouver Area continues to be one of Canada’s most desirable housing markets due to its strong local economy, rapid population growth and highly valued neighbourhoods. The provincial capital of Victoria offers many of the same benefits, with homebuyers flocking to the region for its amenities and lifestyle options. Like many urban markets across the country, the city is focused on the development of all types of housing to meet demand, particularly given the outlook for strong population growth. While home sales and prices have dropped from the market’s February 2022 peak, there are early signs the market is stabilizing and set to rebound.

Ontario continues to offer mortgage investors a source of growth. Ottawa, the National Capital Region, is one of Canada’s most desirable housing markets due to its strong local economy, steady population growth and highly valued neighbourhoods. As the centre for government jobs, Ottawa’s housing market provides a haven during periods of economic or financial uncertainty. Optimism surrounding Ottawa real estate continues to grow as more buyers gravitate to the region from larger cities to secure more space and amenities.

Investing in Alberta’s mortgage market offers many opportunities for investors looking to generate steady returns in some of Canada’s most desirable cities. Calgary and Edmonton rank among the world’s most livable cities and are home to diverse local economies, strong population growth and a lower cost of living relative to other major metropolitan regions. A return to economic strength in the coming years is expected to boost Alberta’s housing market, including demand for private mortgages.

$1Billion+

Mortgage Investments

6-16%

Annual Return

67%

Average LTV

Become a Private Lender with CMI

Private lending represents one of the biggest investment opportunities in Canada. At CMI, we have successfully made over $700 million in mortgage placements across the country. Our dedicated team manages a portfolio of over 1,000 active mortgages targeting annual returns of between 6% and 16%.

Private lending opportunities with CMI:

-

Higher returns than traditional fixed-income securities

-

Income security and stability

-

Backed by real property

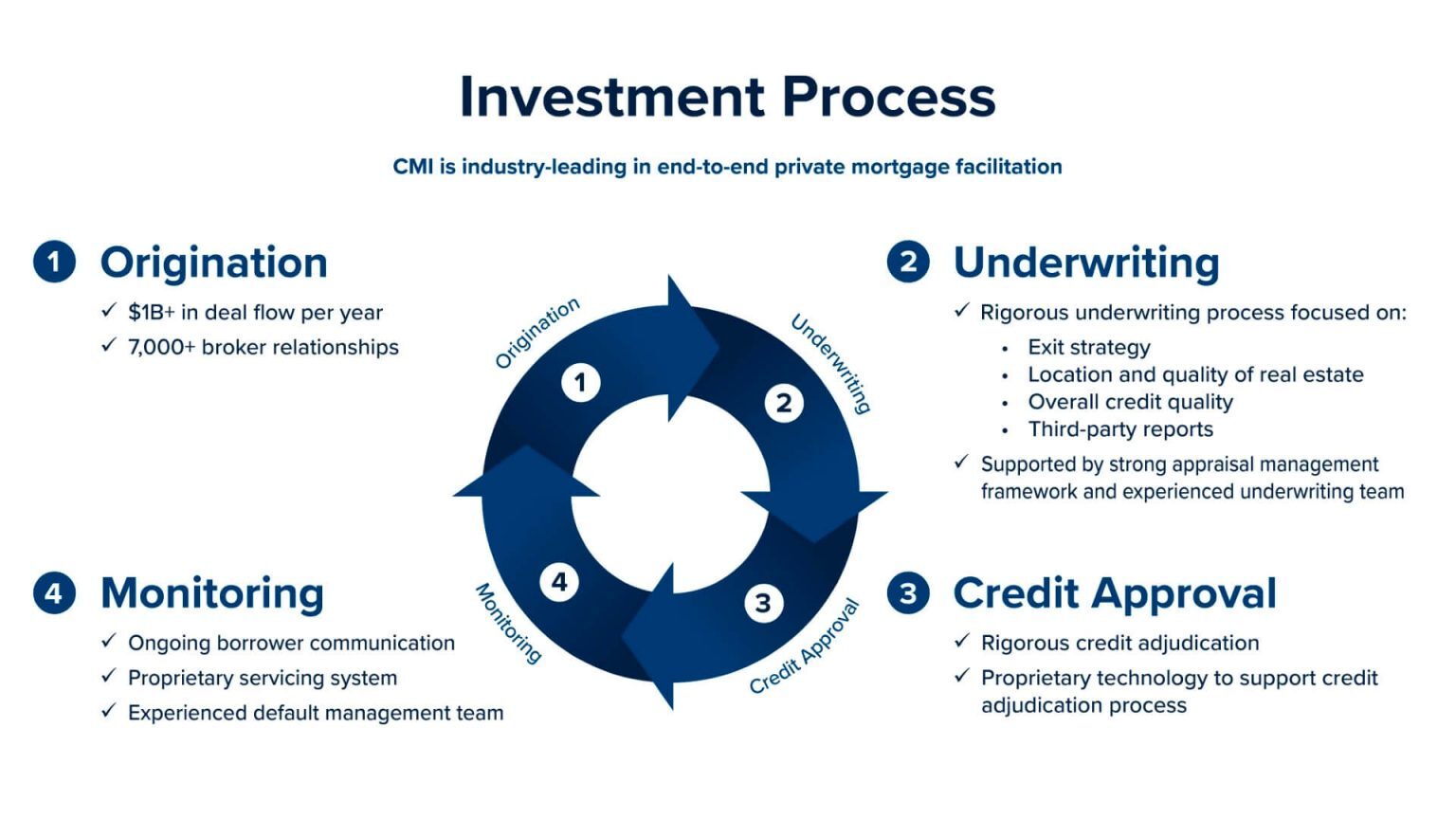

To ensure a seamless, turnkey experience, our diverse team of experts work as part of an integrated platform to manage your investment from origination to discharge.

The CMI Difference

At CMI, we offer safe investment options with the right risk-reward ratio through our “matching system” so we know what loan opportunities work best for our investors.

To ensure you reach your goals, our mortgage team has designated roles that function as one. Each department works as part of an integrated platform ensuring a seamless experience where expertise operates in an effective coordinate manner.

Targeted annual returns of 6-16%

Schedule a consultation with an Investment Account Manager today to get started.