Although the Canadian economy may be going through a recession, the Canadian housing market is rebounding quickly from the pandemic lows. July saw a surge in Toronto house sales, a clear indication that market conditions are improving.

As the market continues to recover, it is becoming apparent that the Covid-19 pandemic simply delayed transactions. The gradual loosening of shelter-in-place orders in Ontario and other provinces has resulted in “supercharged” listing activity, especially for existing homes, according to RBC Economics.

Canada’s Housing Market: By the Numbers

July was a record-breaking month for the housing market, as sales and new listings extended their recovery. On a national level, home sales rose 26% from June and 30.5% annually, the Canadian Real Estate Association (CREA) reported. New listings also rose 7.6% month-over-month.

The national average sale price increased 14.3% annually as housing supply rose in only 60% of local markets. Housing inventory days on market fell to just 2.8 months, the lowest on record.

Source: CREA

Pent-Up Demand Fueling Gains

As Robert Hogue of RBC Economics stated,

“It increasingly appears most real estate transactions that didn’t take place in March through May were simply delayed.”

By RBC’s estimate, as many as 70,000 transactions that would have normally taken place in the spring have been delayed. That means market activity is expected to remain elevated in August and even September as pent-up demand is absorbed.

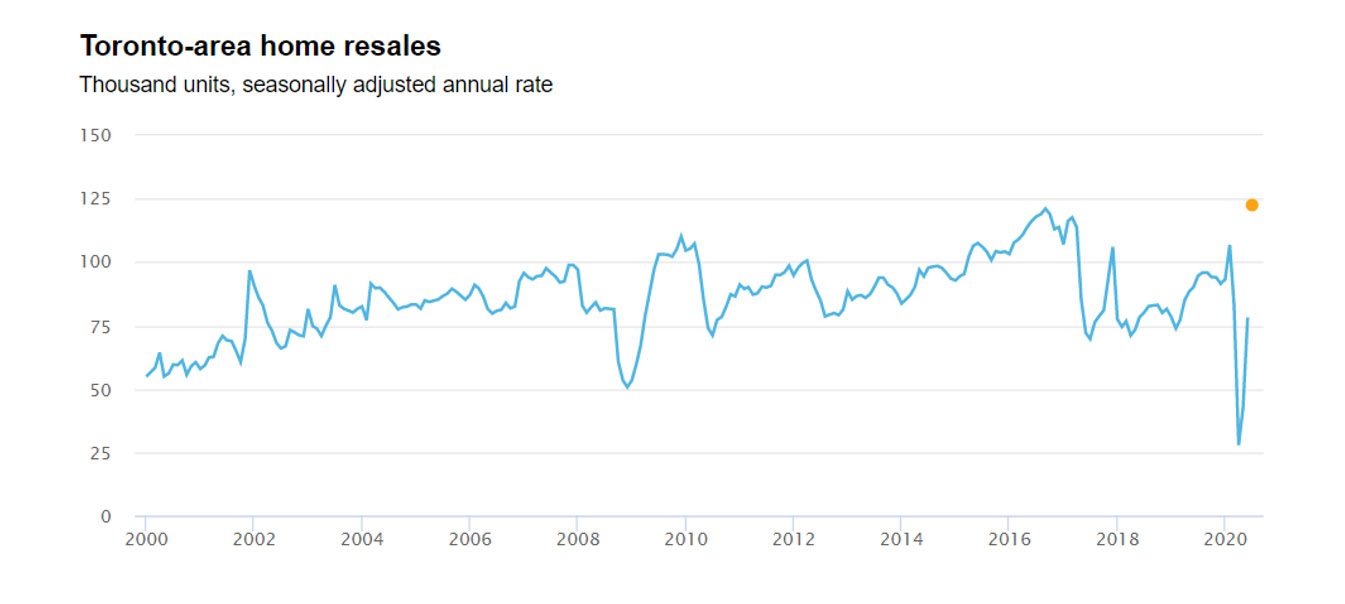

On a seasonally adjusted annual basis, Toronto-area home resales are forecast to have reached 122,500 in July. | Source: RBC Economics

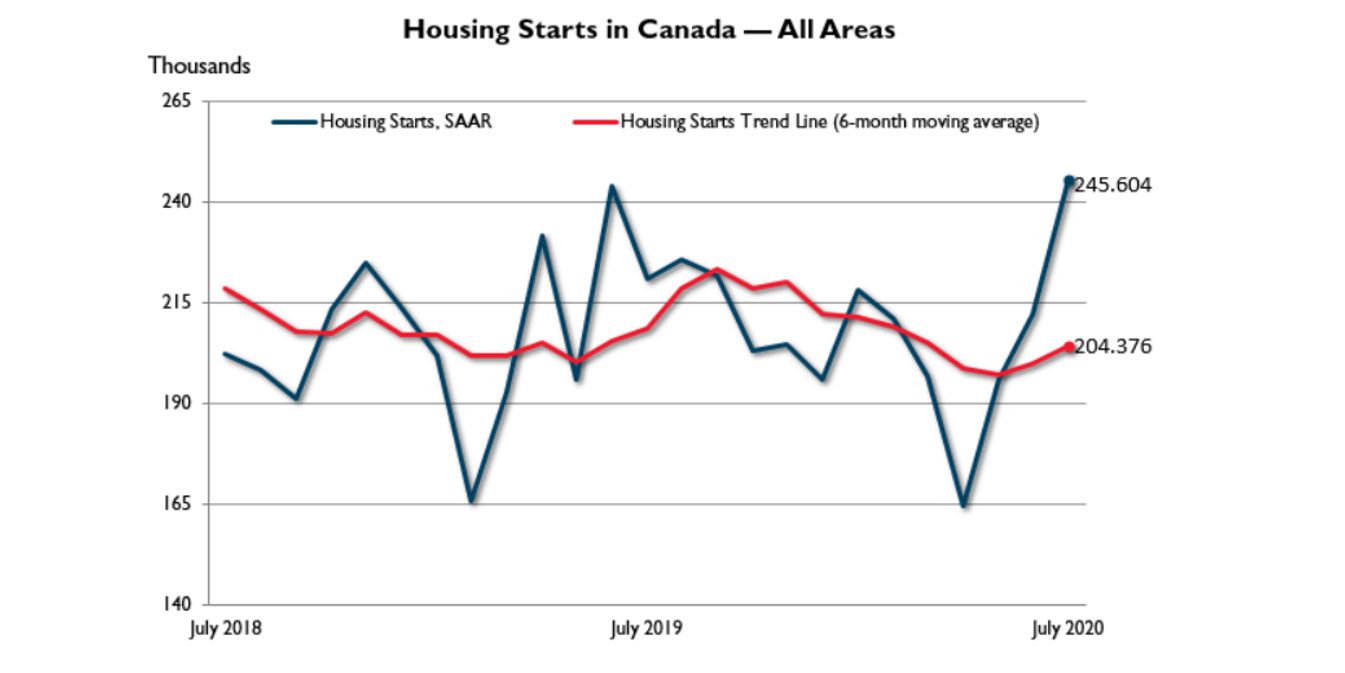

On the supply side, housing starts, a new construction index, also trended higher in July, with multi-family dwelling projects driving the increase. Housing starts increased to 204,376 units, up from 199,778 in June, according to the Canadian Mortgage and Housing Corporation.

Caption: Residential construction is ramping up again. | Source: CMHC

Job Recovery Continues

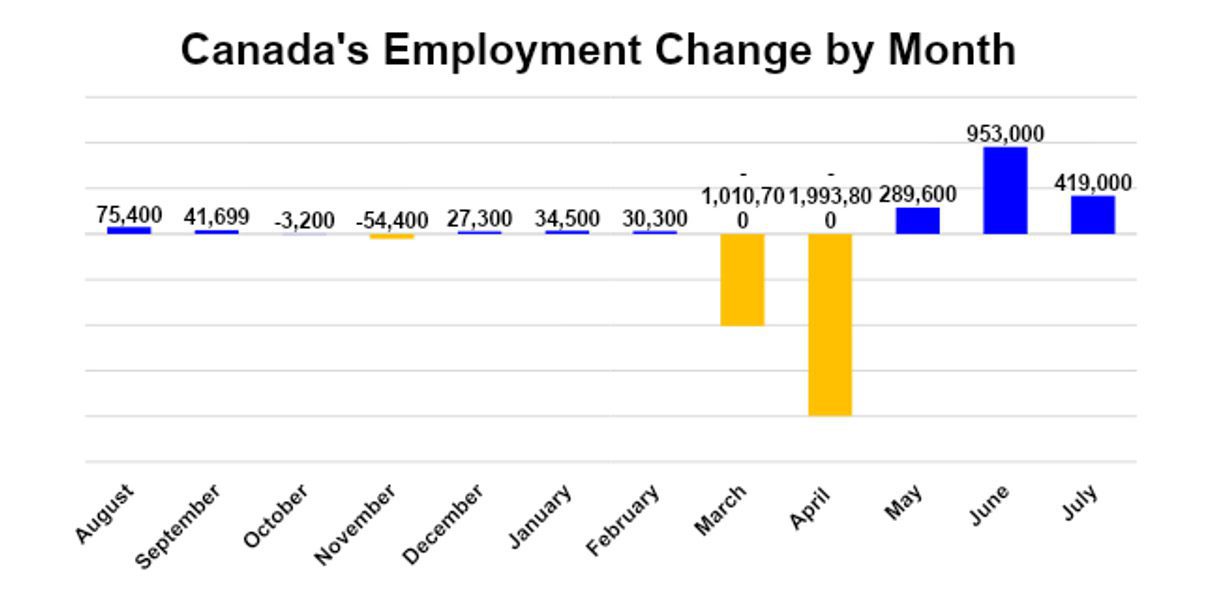

The gradual easing of Covid-19 restrictions contributed to more people returning to work in July. Employers added 419,000 more workers to their payrolls last month, compared with 953,000 in June and 290,000 in May. A total of 3 million jobs were lost between February and April, with an additional 2.5 million absences due to the pandemic.

Canada’s unemployment rate dropped 1.4 percentage points to 10.9% in July. The unemployment rate peaked at a record high of 13.7% in May.

Equity Markets Rebound – But Eye on Risk Remains

North American stocks have outperformed their global counterparts this month, as investors remain cautiously optimistic about the rebounding economy and early trials of a Covid-19 vaccine.

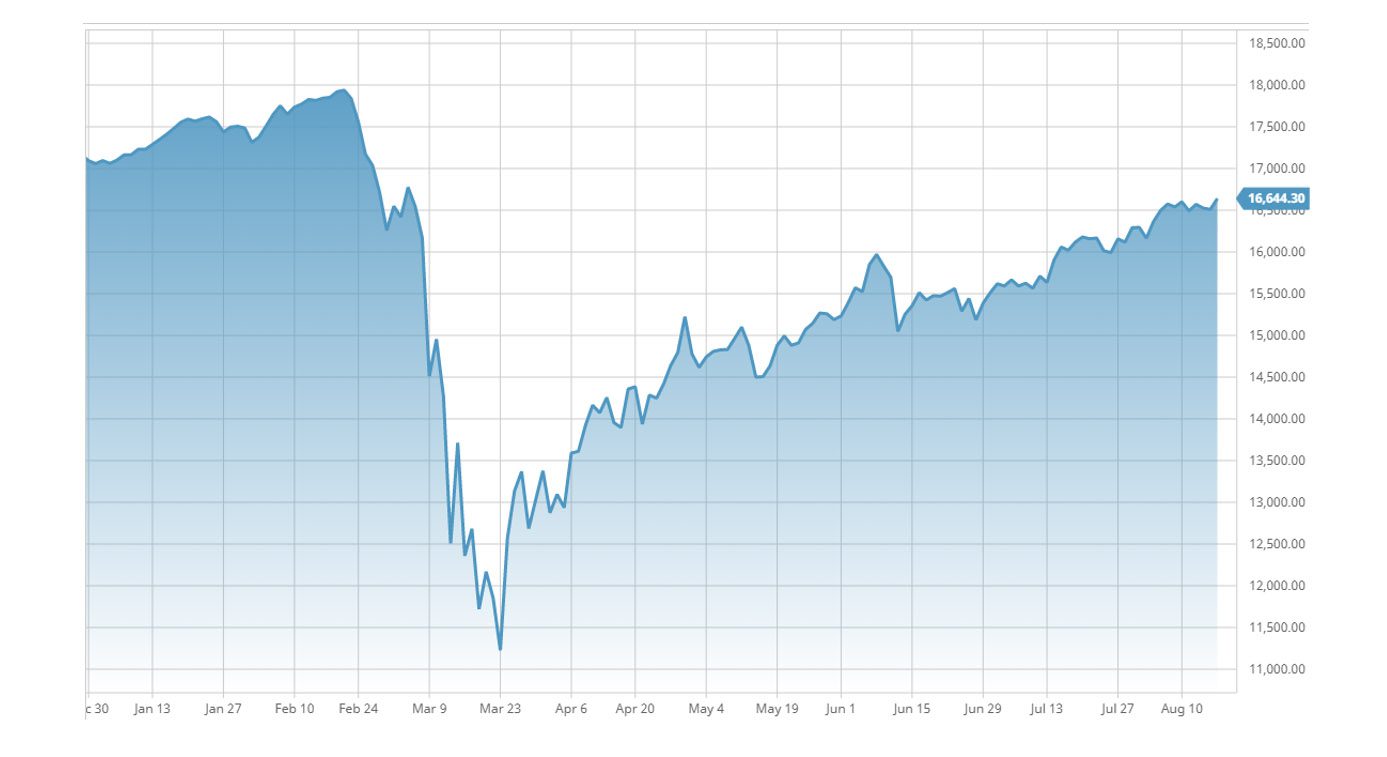

Canada’s benchmark S&P 500/TSX Composite Index has rallied 3% over the past four weeks, trimming its year-to-date losses down to just 2.5%.

The TSX nearly completes a ‘V-shaped’ recovery. | Source: barchart.com

On Wall Street, the Nasdaq Composite Index has set multiple records this summer, while the S&P 500 is nearing new all-time highs.

Although risk sentiment is returning, investors are hedging their bets over concerns that the pandemic will have a lasting impact on the global economy. Mounting U.S.-China tensions and a looming presidential election in the United States are also impacting investor sentiment.

Under these conditions, gold prices surged to new all-time highs in August, with the December futures contract peaking at $2,089.20 a troy ounce. Although gold prices have corrected lower, the yellow metal is still up over 30% year-to-date.

Hedge funds are also building bearish bets on the U.S. stock market as institutions took out their largest short positions in months.

The Bottom Line

Canada’s real estate landscape is living up to its reputation as a stable, resilient market. Listings and sales have rebounded sharply despite the ongoing pandemic. With inventories falling to record lows, the upswing is expected to continue through the early fall.

The broader economic and financial landscape remains uncertain as fiscal stimulus continues to prop up investors, employers, and workers. In the short term, investors can expect higher volatility ahead of the U.S. presidential elections.

CMI invests in residential mortgages that have been shown to outperform cyclical markets during times of instability. The CMI Mortgage Investment Corporation (MIC) targets net annual returns of between 8% and 9% and is comprised of highly liquid assets across multiple segments of Canada’s real estate market.

What Happens Next?

CMI will continue to analyze market changes and keep you updated on a regular basis. To learn more about our investment opportunities fill out the contact form below, and one of our Investment Managers will reach out to you within 24 hours.