The risk-return tradeoff is an investment principle every modern investor must carefully weigh to optimize their success. Although most investors are taught to evaluate their risk tolerance, the current income strategy focuses primarily on investing in assets that can generate returns quickly. While such a strategy has proven successful in the past, not every investor prioritizes growth at all costs. A volatile marketplace only adds to their apprehension about taking excessive risks to generate higher yields. These conservative or otherwise bearish investors place capital preservation near the centre of their investment strategy.

Capital Preservation Defined

Money managers frequently use the phrase “capital preservation” when marketing their products to investors. However, capital preservation refers to a specific investment strategy with the primary objective to preserve capital and prevent loss in a portfolio. In practice, capital preservation strategies entail investing in the safest short-term assets, such as government bonds and Guaranteed Investment Certificates (GICs), rather than a diversified collection of assets that include stocks. While exposure to blue-chip stocks and equity index funds have the best track record of outperforming other asset classes over the long term, they may not be suitable for someone with a capital preservation objective.

Investors may choose a capital preservation strategy for many reasons, the main one being they have limited time to recoup losses if markets experience a downturn or the economy enters recession. For example, an investor nearing retirement may be willing to forego the potential for higher returns in exchange for the security of maintaining their capital. People already in retirement often employ conservative strategies because they rely on the income those investments generate to cover living expenses. If you’re on a fixed income, capital preservation often makes more sense than growth strategies that carry more risk.

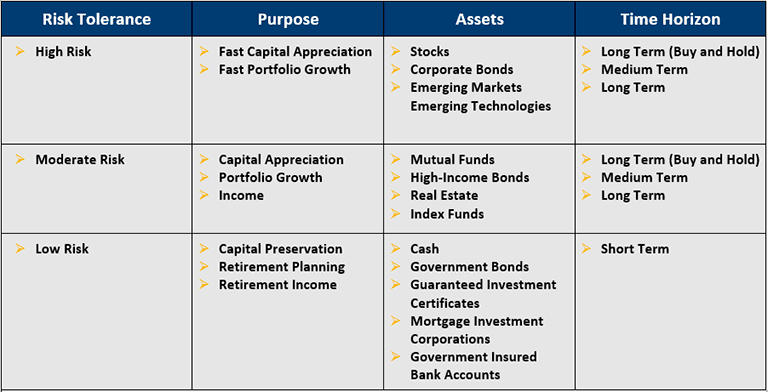

Investor Profiles

Benefits of Capital Preservation Strategies

Preservation of capital is the best approach for investors wishing to retain the monetary value of the assets in their portfolio. By investing in short-term government bonds, GICs or holding cash, investors relying on capital preservation are less likely to lose money. Capital preservation can also provide a predictable stream of income when you need it most. (However, as we’ll soon see, inflation isn’t always easy to beat when your primary objective is preserving capital.)

The benefits of capital preservation also become more apparent during market downturns or recessions. 2022 was considered the worst-ever year for United States bonds and was one of the worst years for growth strategies since the Great Financial Crisis of 2008-09. During this period, a risk-off approach rather than growth would have benefited even the most risk-tolerant investor.

Potential Drawbacks of Capital Preservation Strategies

Capital preservation strategies invest in assets that carry very little risk and, therefore, generate lower returns than other investment methods. By eliminating or significantly reducing risk in their portfolio, conservative investors who employ this method earn lower rates of return. Although this is the intended effect, ultra-low yields have made “safe” investments harder to justify over longer periods. And while bond yields have risen over the past year, so has inflation – and by a significant margin – leaving capital preservation strategies at risk of underperforming inflation over extended time frames. In fact, capital preservation using traditional assets such as bonds or GICs cannot sustain current levels of inflation.

As mentioned previously, very few strategies in today’s market are truly considered “safe.” Unless you are prepared to accept the possibility of zero – or even negative – returns after inflation, a traditional capital preservation strategy may not be the best option.

Mortgage Investments Can Preserve Capital and Beat Inflation

The primary cons of capital preservation strategies – very low rates of return and the erosion of the nominal value of cash and assets – do not apply to mortgage investments. This emergent class of alternative investments is responsible for filling a crucial need in Canada’s residential mortgage market by extending credit to a diverse range of borrowers. As banks continue to tighten lending guidelines, private lenders are playing an increasingly important role in ensuring that borrowers have reliable access to credit. According to Statistics Canada, non-bank mortgage lenders, also known as private mortgage lenders, account for roughly 2% of the overall mortgage market.

From an investor’s perspective, mortgages are defensive cash flow investments that are more like other fixed-income assets. Mortgage investments are secured by real estate, but do not carry the same risk profile as a direct real estate investment. Where mortgage investments diverge from other defensive assets is in their expected rates of return.

Mortgage investments have historically provided significantly higher rates of return than conventional fixed-income securities that make up most defensive portfolios. While past performance doesn’t guarantee future success, mortgage lenders that practice careful due diligence and employ a rigorous mortgage selection process are more likely to achieve their yield targets while still providing the capital preservation benefits that bearish or defensive investors need. By investing in mortgages, investors can also benefit from historically strong mortgage repayment trends in Canada where defaults remained ultra-low even during the COVID-19 pandemic.

Mortgage investments make sense for defensive investors seeking a steady cash flow from assets that are generally non-correlated with public markets. Mortgage investments are also suitable for retirement planning because they provide passive income and are also eligible for tax-deferred investment accounts, such as RRSPs, TFSAs and RRIFs.

Mortgage Investing With CMI

CMI Mortgage Investments is Canada’s premier mortgage investment institution. With over $1.8 billion in mortgage placements, our investment strategies have consistently delivered annualized returns of between 6% and 16%, providing peace of mind to defensive and cash-flow-focused investors. Our investors benefit from a rigorous due diligence process that utilizes our expert teams to effectively manage risk while targeting the highest quality mortgage opportunities across Canada. We provide borrowers with a viable exit strategy that allows them to improve their financial situation and move from the private space back to an A lender at the end of their loan term. The entire adjudication, underwriting and mortgage selection process is managed by our team of professionals with over 100 years of cumulative experience in the mortgage industry.

CMI Mortgage Investments has built one of Canada’s largest mortgage investment programs through years of professionalism, transparency, and industry-leading due diligence practices. Explore our whole mortgage investment program and contact one of our Investment Managers to schedule a free consultation.