In this note, we briefly discuss three economic developments. First, we look at the recent global economic forecast updates by the International Monetary Fund (IMF). The global economy is looking more positive, but growth in most of the western world is expected to remain muted. Next we look at growth in Canada, which is expected to have stalled in December as activity slows in interest sensitive sectors. Finally, we look at inflation, which has been declining. The Federal Reserve raised rates by 0.25 percentage points – the debate is how fast inflation will decline and whether any policy action from the Fed will be required.

Better global growth prospects seen for 2023

The IMF revised upwards its global growth projections for the year to 2.9%. Higher interest rates and the invasion of Ukraine remain risks to the outlook. The Fund notes that economic growth remained resilient in the third quarter of last year and inflation has shown improvement. Advanced economies are expected to grow at a subdued pace of 1.2% in 2023. The emerging market and developing economies are the main global engine, growing at an expected 4% this year. China’s announced reopening after its COVID lockdown is expected to contribute to higher global growth.

Canadian economy edged higher in November, but zero growth expected in December

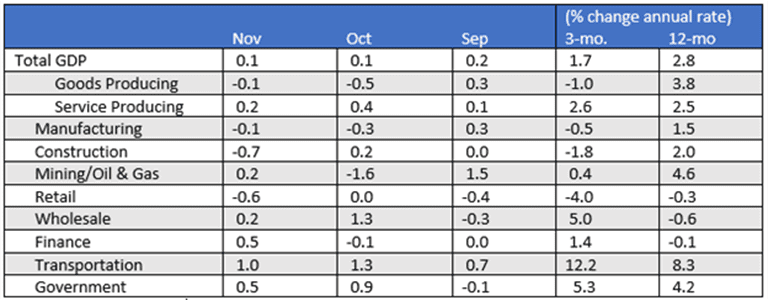

The Canadian economy expanded by 0.1% in November. Statistics Canada’s flash estimate for December shows no change. Growth was broad-based as 14 of 20 sectors increased; service-producing industries grew (+0.2%) while good-producing industries decreased (-0.1%).

Of note was the weakness in residential construction (1.8%). Stats Can noted “all types of residential activity fell in November, with new construction of single detached homes and home alterations and improvements leading the contraction.” Retail trade also declined (-0.6%)

Based on this data, GDP for the quarter is expected to come in at 1.6% (quarterly annualized). This is slower than the previous three quarters and reflects the Bank of Canada policy tightening. Rate sensitive sectors such as construction and retail are starting to show the effects of higher interest rates.

Monthly Real GDP

(month/month % change)

Source: Statistics Canada

Jobs numbers underscore the risk of further Fed rate increase

The Federal Reserve announced that it is raising interest rates by 25 basis points, following its most recent meeting. This increases the federal funds rate to a target range of 4.5 to 4.75%. This is the eighth consecutive meeting where the Fed has raised rates to bring inflation under control. It was the smallest move by the Fed since last March.

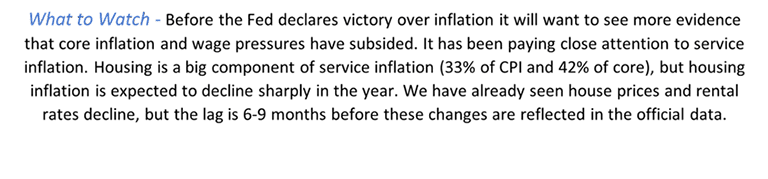

This increase comes as inflation hit 6.5% in December 2022. While inflation has shown signs of slowing, the Fed signaled that more increases may be coming this year to further bring down inflation. Labour markets are still strong.

Most Federal Open Market Committee (FOMC) members are expecting that the fed funds target ranges would need to be raised to above 5% this year. Currently there is a disconnect with the market view for cuts this year and the Fed’s perspective. While the general expectation is for inflation to fall fast this year, the question is whether it will stay above target.

FOMC’s suggested path to overtighten policy is due to their concern about persistent underlying core inflation. The Personal Consumption Expenditures Price Index (PCEPI) – the core inflation measure the Fed follows – is tracking above policy targets. The market, on the other hand, has started to anticipate a pause and potential cut in rates.

After the Fed announcement, 5-year Treasuries moved lower to reach an intra-week low of 3.43%, leaving this measure down nearly 50 basis points since the beginning of the year. The extremely strong payrolls gain of 517,000 for January, announced on Friday, threw cold water on this rally, with yield up around 20 basis points from the mid-week low. The surge in hiring was spread across most industries and the jobless rate fell to a 53-year low of 3.4%. While average hourly earnings continued to moderate, rising 0.3%, aggregate work hours were up 1.2% in the month. With these kinds of numbers, it is hard to see how the U.S. is slipping into a recession. Strong labour market numbers will make it harder for the Fed to step back from further rate increases.

The Fed’s next interest rate announcement is scheduled for March 22.

Independent Opinion

The views and opinions expressed in this publication are solely and independently those of the author and do not necessarily reflect the views and opinions of any person or organization in any way affiliated with the author including, without limitation, any current or past employers of the author. While reasonable effort was taken to ensure the information and analysis in this publication is accurate, it has been prepared solely for general informational purposes. Any opinions, projections, or forward-looking statements expressed herein are solely those of the author. There are no warranties or representations being provided with respect to the accuracy and completeness of the content in this publication. Nothing in this publication should be construed as providing professional advice including investment advice on the matters discussed. The author does not assume any liability arising from any form of reliance on this publication. Readers are cautioned to always seek independent professional advice from a qualified professional before making any investment decisions.