Canadian home sales rose at a brisk pace in February, as more homeowners listed their properties for sale ahead of the busier spring season. The Bank of Canada’s decision to start raising interest rates could have a material impact on mortgage costs in the near term, which could prompt more buyers and sellers into the market before borrowing costs rise further.

Home Sales Rise in February: CREA

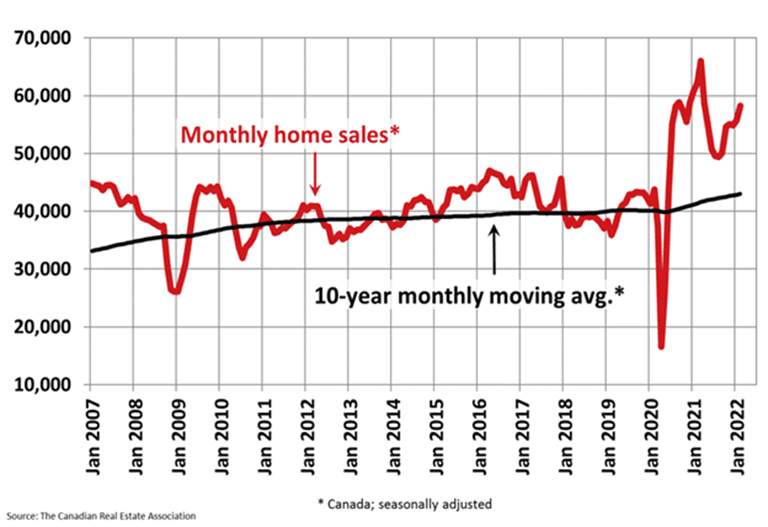

Nationally, home sales rose 4.6% between January and February according to the Canadian Real Estate Association (CREA). The number of newly listed properties increased 23.7% month over month. Sales volumes were up in about 60% of local markets measured, led by the Calgary and Edmonton areas.

Despite the increase in inventory, home values continued to rise at double-digit percentages on an annual basis. The MLS Home Price Index rose 3.5% during the month, and 29.2% year-over-year, both records.[1] CREA said the average cost of a home in Canada is now $816,720, also a new record. That’s over 20% higher than a year ago. CREA highlighted that the national average price is heavily skewed by activity in and around Vancouver and Toronto, Canada’s most active and expensive housing markets.

National home sales remain elevated compared with the long-term average. Source: CREA.

Housing Market Gears Up for Pivotal Spring Season: RBC Economics

Amid a dearth of supply in the Canadian housing market, buyers got some much-needed relief in February as more sellers put their properties up for sale. Local real estate boards led by Calgary and Edmonton registered a higher number of listings in February according to RBC Economics, corroborating CREA’s monthly housing data.

“Sellers will play a central role in shaping up this year’s spring season,” said Robert Hogue, Senior Economist at RBC. Hogue cited rising interest rates as a potential reason for a greater number of new listings in the spring should “current homeowners see the coming months as an opportune window to list their property.”[2]

Labour Market Recovery Continues

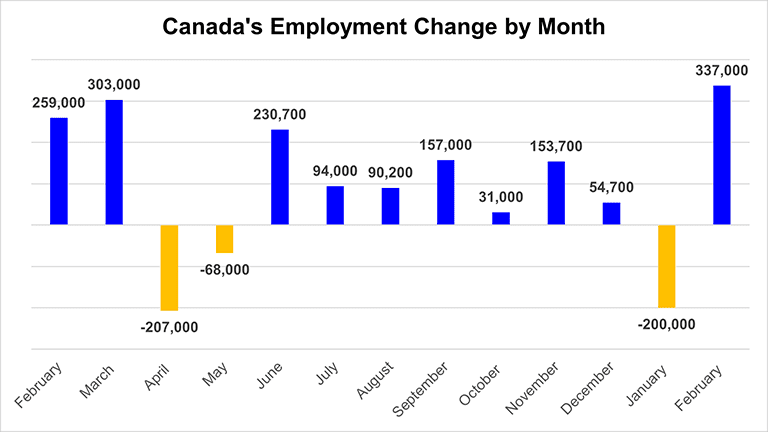

Canada’s labour market recovery continued in February, as the unemployment rate fell to its lowest level since before the COVID-19 pandemic. The jobless rate dropped to 5.5% during the month, putting it below the 5.7% level not seen since February 2020, according to Statistics Canada.

The country added 337,000 jobs in February, more than offsetting the loss of 200,000 positions in January that were largely attributed to temporarily renewed pandemic restrictions.[3]

Canada has recorded job growth in eight of the last nine months. | Data source: Statistics Canada.

Markets Slide on Rate Hike Expectations, Ukraine Crisis

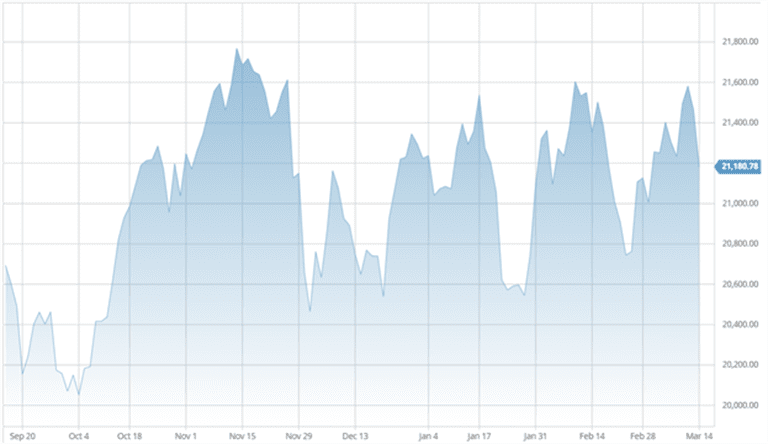

Both Canadian and American stocks have experienced sharp declines over the past month. The technology-concentrated Nasdaq officially entered into bear market territory with an even more significant decline than the broader indices. Investors continued to monitor the war in Ukraine, surging commodity prices and their impacts on inflation, and expectations of further monetary policy tightening from central banks.

The TSX has fared better comparatively than its U.S. counterparts, down only 3.1% from the all-time high set in November 2021. The S&P 500 and Dow have each entered correction territory – defined as a loss of 10% or more from a recent peak – during the recent slide.

The TSX Composite Index has traded choppily since November. Source: Barchart.com

Conclusion and Summary

The Bank of Canada raised their prime lending rate for the first time in over three years on March 2nd, as policy makers began taking steps to combat surging inflation. The overnight rate target increased by 25 basis points to 0.5%, still well below historical averages. A higher overnight rate impacts consumers as banks and other lenders pass along those rate hikes that make borrowing more expensive for borrowers. In this environment, rates are expected to rise gradually in the short term.[4]

What Happens Next?

CMI Financial Group will continue to analyze market changes and keep you updated on a regular basis. Learn more about investing in private mortgages.