Canadian home sales continued their downward slide in September, reflecting a broad cooling trend that began earlier this year when the Bank of Canada (BoC) signaled its intent to begin raising interest rates. With policymakers focused on restoring price stability, it’s expected that interest rates will continue to rise heading into 2023. A higher BoC policy rate has an indirect impact on mortgages as financial institutions pass on the higher costs of borrowing to consumers.

Home Sales Fall in September: CREA

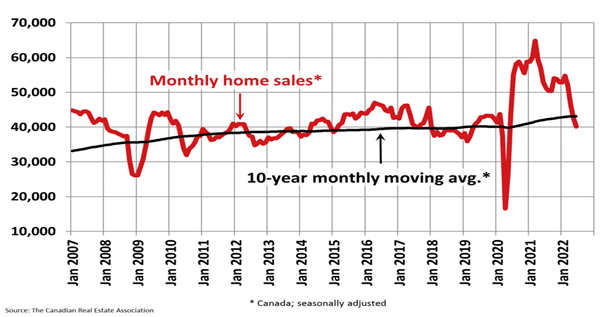

On a national level, home sales declined in September for a seventh consecutive month, falling 3.9% compared to August, according to the Canadian Real Estate Association (CREA). Actual home sales were 32.2% lower than in September 2021, when the housing market was still running hot on post-pandemic stimulus.

CREA said that roughly 60% of local markets saw fewer home sales in September, including the Greater Toronto Area, Greater Vancouver, Calgary and Montreal.

Property values also continued to moderate, with the MLS Home Price Index declining 1.4% month-over-month.

Home sales have fallen below their 10-year monthly moving average. Source: CREA.

Canada’s Housing Market Faces Major Affordability Constraints: RBC Economics

Rising interest rates and elevated price levels have driven home ownership costs to record highs in Canada, according to Robert Hogue, economist at RBC Economics. RBC’s national aggregate affordability metrics, which measures ownership costs as a percentage of median household income, reached 60% in the second quarter, surpassing the previous high of 57% set in 1990. The analysis found that buyers in Ontario and British Columbia were “extremely challenged,” though conditions were still manageable in the Prairies, Quebec and most of Atlantic Canada.

“The Bank of Canada’s rate hiking campaign since March has added hundreds of dollars to mortgage payments that come with a home purchase,” said Hogue. “This, along with the jump in property values during the pandemic, have made it more difficult than ever to become a homeowner in Canada.”

Labour Market Conditions Little Changed in September

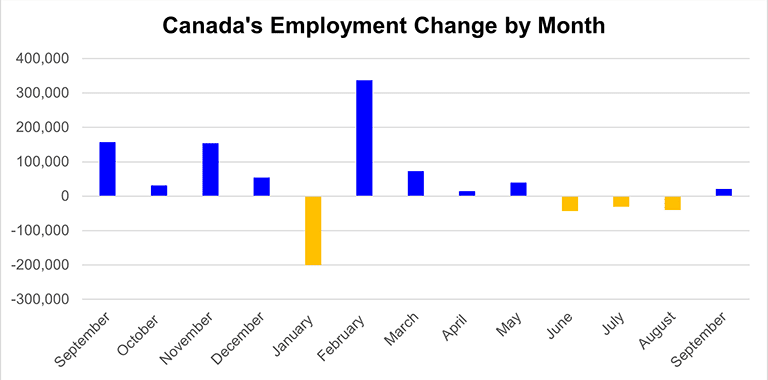

After consecutive monthly declines, Canada’s labour market rebounded slightly in September, with employers adding 21,000 workers to payrolls during the month, according to Statistics Canada. On an industry level, employment rose in education services and healthcare and declined in manufacturing and information, culture and recreation. The overall unemployment rate edged down 0.2 percentage point to 5.2%; however, the workforce participation rate also edged slightly lower by 0.1 percentage points to 64.7%.

Canadian jobs growth has stagnated in recent months. Data source: Statistics Canada.

Volatility Returns to Equity Markets

Wall Street and Canadian stocks declined sharply through the first two weeks of October, as concerns about monetary policy and economic growth weighed on investor sentiment. Toronto’s benchmark TSX Composite Index briefly fell below 18,000 on Oct. 13, before staging a large relief rally. In the United States, the Dow Jones, S&P 500 and Nasdaq Composite Index have each declined between 4% and 10% over the past 30 days.

The TSX Composite Index has printed a series of lower highs, which is usually a bearish formation. Source: barchart.com.

Conclusion and Summary

While the BoC has already hiked interest rates five times this year, more upward adjustments may be needed to tame inflation, according to Governor Tiff Macklem. The BoC’s policy rate currently sits at 3.25%; however, pricing in overnight swap markets indicates that investors expect the benchmark rate to reach 4.25% by mid-2023. Investors are pricing in higher interest rates after the U.S. core inflation rate reached a new four-decade high in September.

What Happens Next?

CMI will continue to highlight market trends and keep investors informed. Visit our website to learn more.

Learn more about investing in private mortgages.